How to Set Up Your Payment Policies: Key Considerations

Setting up clear and strategic payment policies is essential for minimizing no-shows, simplifying your operations, and providing a seamless experience for both your business and clients.

Once you’ve connected your payment processor to Acuity Scheduling, you can take advantage of several payment features to customize how clients pay:

Deposits or prepayment: Decide if clients pay a deposit or the full amount upfront.

Credit card vaulting: Securely save card details to reduce no-shows and simplify future bookings.

Tipping: Enable clients to leave a tip during checkout.

Invoicing: Send professional invoices for appointments or additional charges directly from Acuity.

Not sure where to start? Below are 7 key considerations to help you optimize your payment setup with policies tailored to your business.

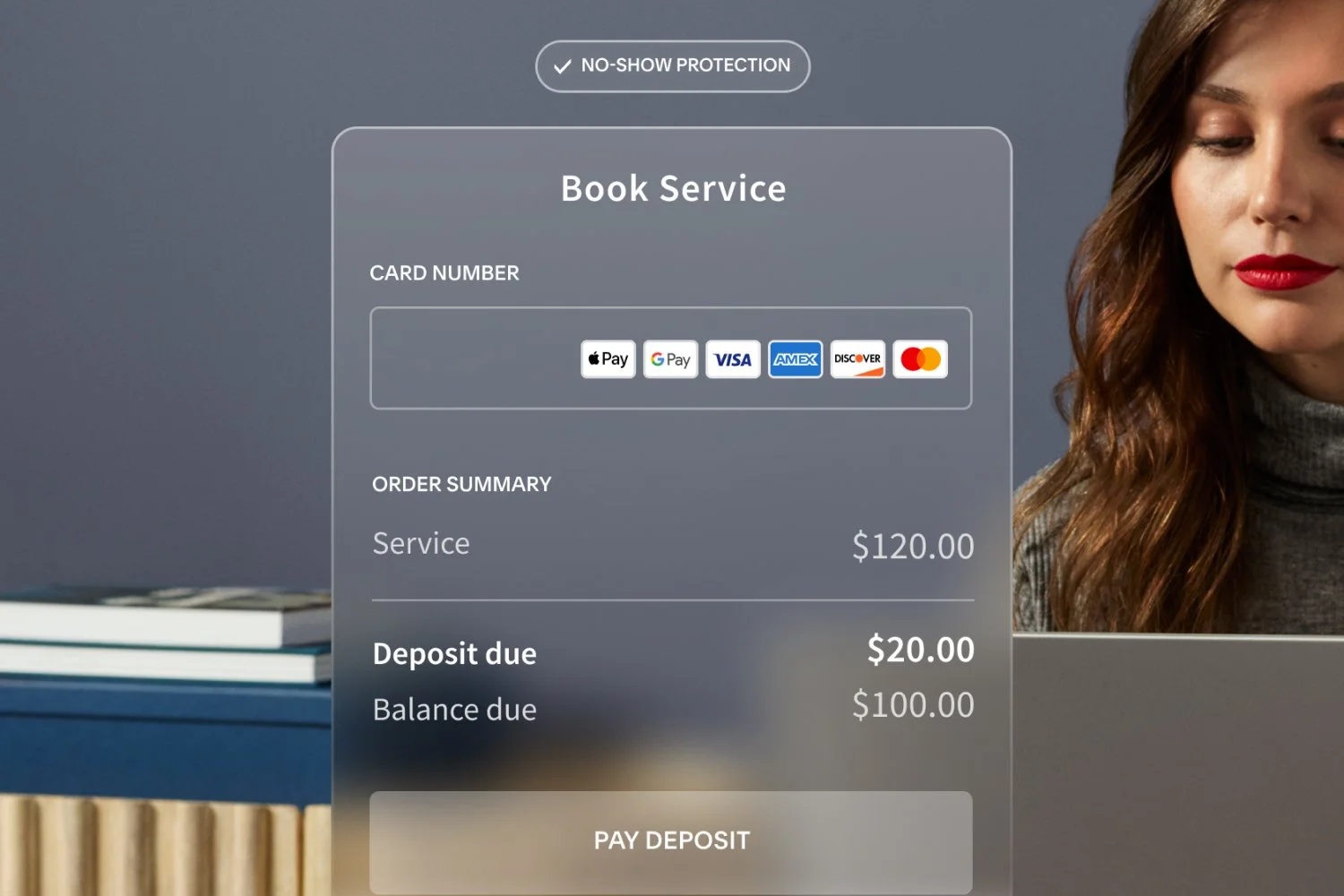

1. Setting a deposit

Requiring a deposit is a simple and effective way to reduce no-shows and secure your revenue.

How to set a deposit: Navigate to your payment settings in Acuity and enable the deposit option. This allows you to collect partial payment upfront, with the remaining balance payable in person.

How much to collect: A good rule of thumb is to request 20 to 50% of the total appointment cost as a deposit. This amount is substantial enough to secure commitment, but not so high as to discourage bookings. For high-demand appointments or premium services, consider requiring a higher deposit—or even full payment.

Pro tip: If you use Stripe or Square, the client’s card details are automatically saved when they pay a deposit. This enables you to charge for no-shows and simplifies future payments, too.

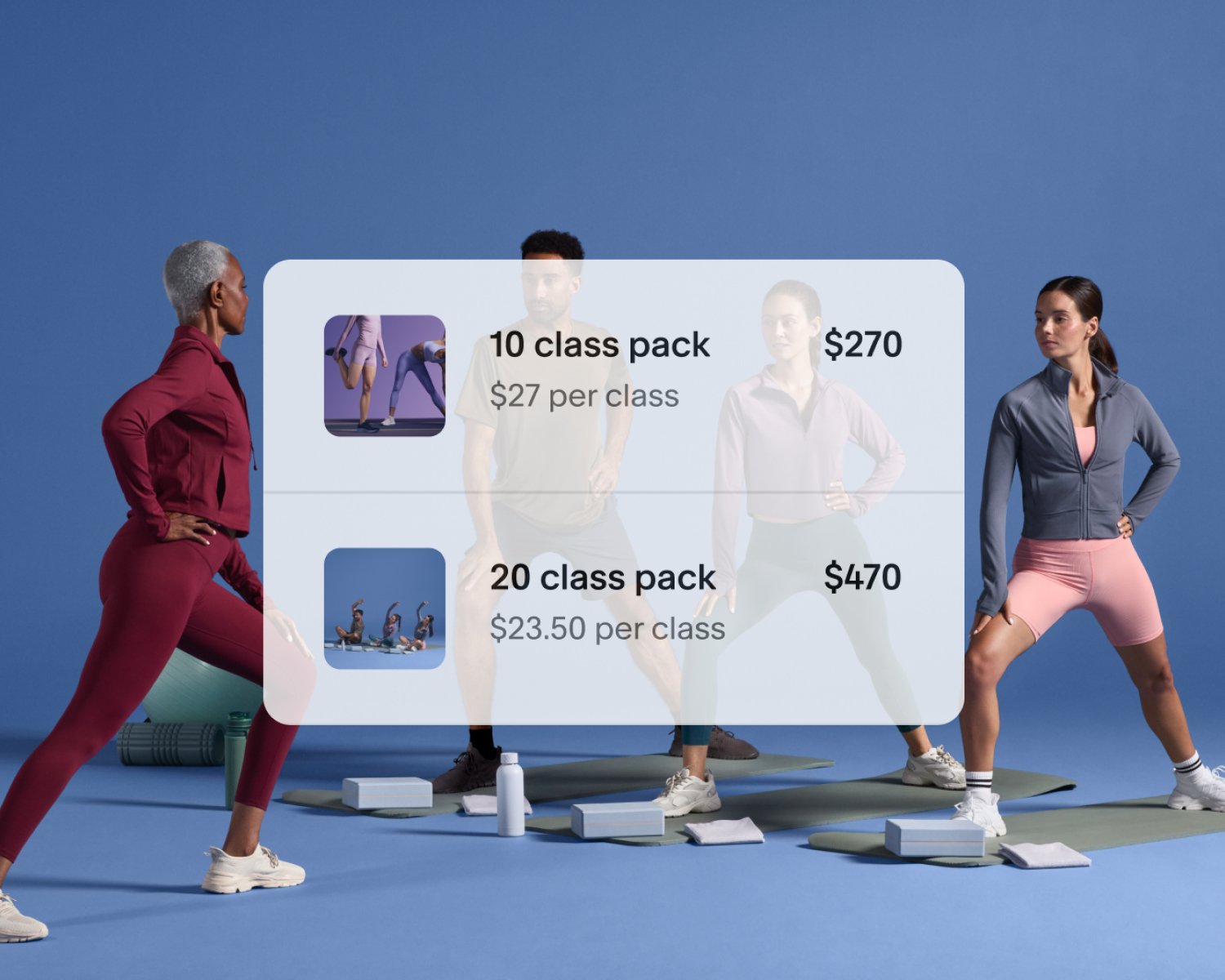

2. Requiring full payment at booking

For maximum protection against no-shows and cancellations, collect the full payment upfront. This policy is particularly useful for services that are high in demand or appointments with limited availability.

Pro tip: If you’re unsure whether full payment is right for your business, start with deposits and transition to upfront payments once you’ve established client trust and operational consistency.

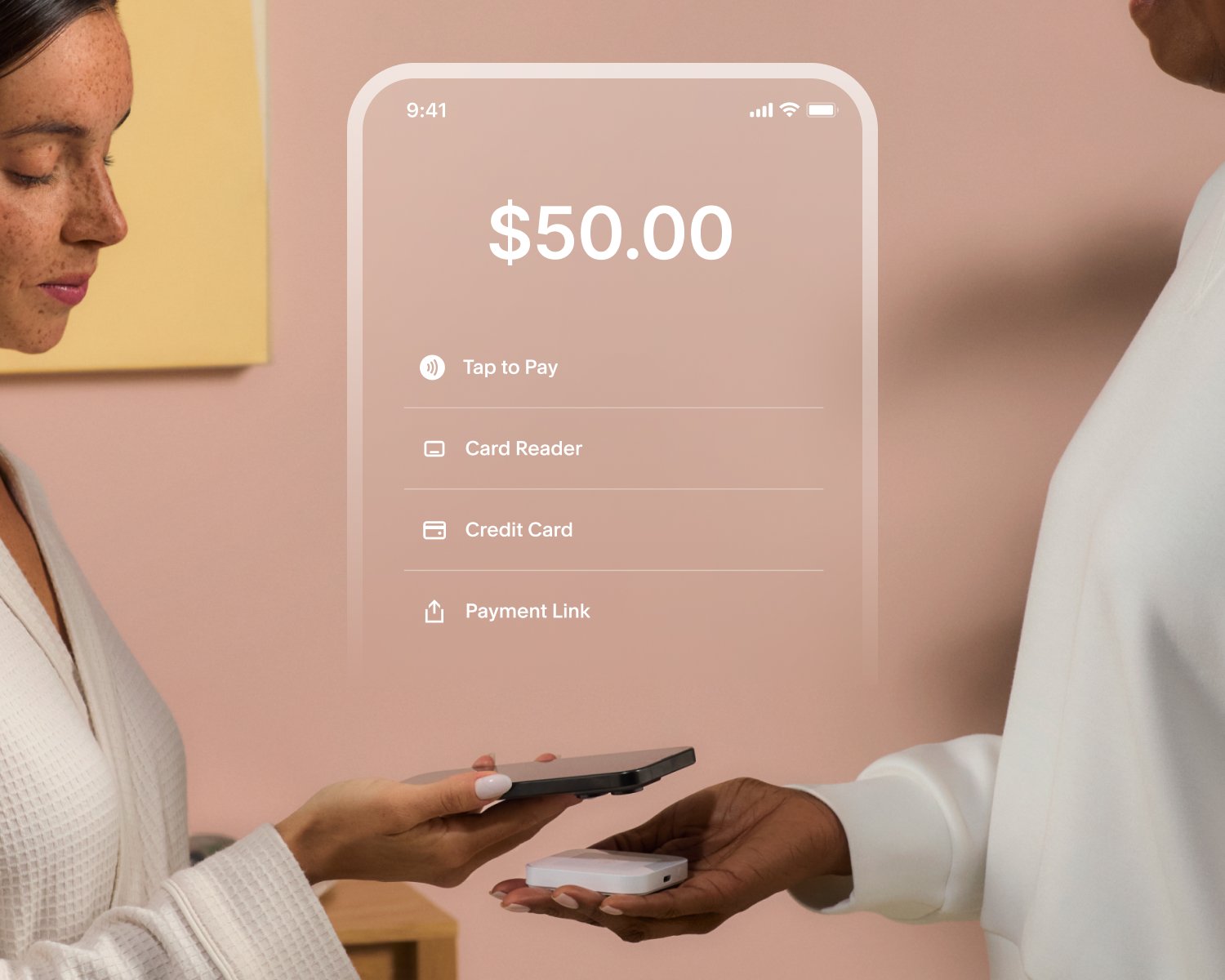

3. Saving card details for future payments

Securely storing card details with Stripe or Square allows you to streamline future transactions and reduce the chance of no-shows or unpaid balances. When a client makes an initial deposit or payment, their card information is saved automatically, making rebooking a breeze.

4. Setting the right currency

Ensure your payment settings reflect the currency you use in your business and your payment processor. Maintaining this consistency across platforms helps avoid confusion for clients and reduces the likelihood of payment errors.

5. Enabling tipping

Adding a tipping option during checkout is an easy way to boost revenue, especially in industries like beauty and wellness. By enabling this feature, clients can add gratuity to show appreciation for your services while increasing your earnings. (Note: Tipping with PayPal is only available to users on Acuity’s new scheduler.)

6. Staying consistent across appointment types

For a seamless client experience, use the same payment method—such as deposits, full payments, or card vaulting—across all appointment types. Consistency eliminates confusion, enhances professionalism, and ensures clients understand what to expect.

7. Setting (and enforcing) a clear cancellation policy

Your payment policies should complement a well-defined cancellation policy. If you collect deposits or payments upfront, clearly explain what happens if clients cancel, reschedule, or don’t show up for their appointment. This transparency protects your business and sets expectations for clients. Learn how to create a cancellation policy.

Set your payment policies for success

With Acuity’s flexible payment features, you can customize your policies to suit your business and client needs. Set up your payment policies today to protect your time, streamline operations, and improve client satisfaction.